1. Introduction

Uruguay has experienced a significant technological revolution in recent years, with advances in connectivity, education, innovation, government policies and software development1. Since the beginning of the 21st century, scientists have identified this advance as “the Fourth Industrial Revolution,” clearly linked to previous technological developments 2)(3) . The Fourth Industrial Revolution refers to the integration of digital, physical and biological technologies, marking a convergence between physical, digital and biological worlds 2)(3) . There are also mentions to a “fifth technological revolution”, related to the even closer integration between humans and machines, but the term is not as widely accepted 4)(5) . Therefore, the fourth revolution is still profoundly transforming industries, sectors, and our daily lives in the way we communicate, work, educate, and entertain ourselves6.

In rural and agricultural areas, these effects are currently seen through, for example, precision agriculture, connectivity (enabling rural communities to access online services, distance education, telemedicine, e-commerce, and remote work), and more accessible renewable energies 7)(8) . The potential of these technologies is to improve the efficiency of agricultural operations, food safety, and product quality for consumers. In the fruit and vegetable trade, for example, digital technology such as online platforms can allow farmers to sell their products more directly to consumers, keeping most of the product value, and reducing logistics costs and food waste. Also, it can provide tools to track and verify the provenance and value of products, which can be especially important in short chains where transparency and trust are essential9.

However, difficulties have been faced in this area linked to market size (which can limit the potential for technology companies seeking to expand), the lack of specialized talent in certain technological areas (such as artificial intelligence, science data, and cyber security), the lack of investment in research and development, the possibility of access to financing (there may be obstacles even if there are government programs and venture capital funds available), and the complexity of regulations and procedures. Furthermore, there is still a significant digital divide (in terms of access to technology and digital literacy), especially in rural areas and among disadvantaged socioeconomic groups, which can translate into a lack of opportunities for certain segments of the population and should be addressed by comprehensive approaches10.

In this sense, this study aims to delve into the impact of the potentials and difficulties of digitalization on the real experience of the fundamental actors in the Uruguayan fruit and vegetable chain (producers, merchants, middlemen, consumers, and private and public technicians). Efforts to promote innovations for advanced technologies and sustainable practices in this sector are vital since it supplies the country with fresh and nutritious products, being crucial for the population health, representing 10% of the gross value of agricultural production in Uruguay. In addition, horticultural and fruit farms generate 15% of total agricultural employment and they are predominantly family-owned (more than 70% of the farms are managed by family farmers), contributing significantly to the economic support of rural communities and their social cohesion11.

Therefore, social actors who are innovating in the fruit and vegetable commerce were described (together with their projects) and consulted in search of appreciation, points of view and opinions regarding technical innovations, barriers to commercialization, family labour, public policies, pressure for land use, and other complex problems12. In this publication (which is part of a broader doctoral investigation) we specifically intend to document the depth of knowledge we achieved regarding through what the interviewed actors think and defend from their position giving raise to discussion and suggestions that might help to orientate further political discussions.

2. Methodology

To illustrate the abundance of perceptions according to the methodology of Soft Systems in action13, 39 interviews (38 individual interviews and 1 group interview) with semi-structured questionnaires14 were carried out at INIA Las Brujas from November 2022 to February 2023 in a collaboration between the regional director (Mag. Alejandro Pizzolon) and our team from the School of Agronomy-Udelar.

Soft system methodologies embrace exploring boundaries (with a participatory engagement of stakeholders to understand the wicked problems) and using mixing methods15. They invite researchers in the natural sciences to employ some of the techniques and methods that social scientists have developed before to encourage discussion in order to build a “rich picture” to study a situation by representing the variety of perceptions. “It takes a combination of semi-structured interviewing, problem mapping, interactive planning, critical systems heuristics, and viable system modelling to support stakeholders in both defining the issue and responding to it systemically”15.

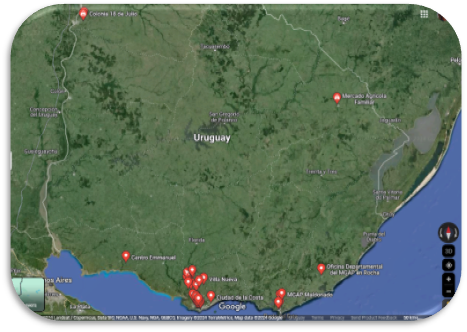

Therefore, initially, we started with a list of relevant contacts (representing actors of the vegetable and fruit commerce who are undertaking digitalization processes) provided by INIA, continuing by selecting interviewees from a “snowball sampling” (a process where a subject gives the researcher the name of another and so on, to find the research object), attempting to represent all the different categories of agents of the sector16. Thus, we obtained information mainly from actors in the south and some points in the northwest and central east of Uruguay (Figure 1).

During the exchanges, the aim was to consider experiences regarding digital, commercial, and technical innovations and their impacts on social dynamics12. For that, the questionnaires contained guiding questions which gathered information about innovations in ventures, relationships between public and private sector actors (mainly with clients), forms of communication, financing opportunities, support policies, main learnings and future vision on the interrelationship between rurality and the digital world.

While sharing focused discussions, participant observations and workshops17, social actors become active researchers, participating in the identification of strengths or potential problems to be investigated, in the collection of information, in decision-making, in the processes of reflection and action18. They become researchers and beneficiaries of the findings and solutions or proposals19.

Qualitative and reflective methodologies were essential to generate an environment of trust 16) and delve deeper into the causes of a social phenomenon from the view of people who are in fact taking part of it, containing beliefs (which are driving daily decisions) that would not be expressed spontaneously. Therefore, the focus was on deepening knowledge of a particular and novel sector and not on pursuing criteria of exhaustiveness.

The conclusions of this work (with visual models of interactions, mapping, and other techniques of systematization) were shared at INIA Las Brujas in a workshop format where participants gave their opinions (especially as customers) to continue enriching the debate around the main problems of the farming sector and thinking of solutions.

3. Results

3.1 Main actors of the fruit and vegetable chain

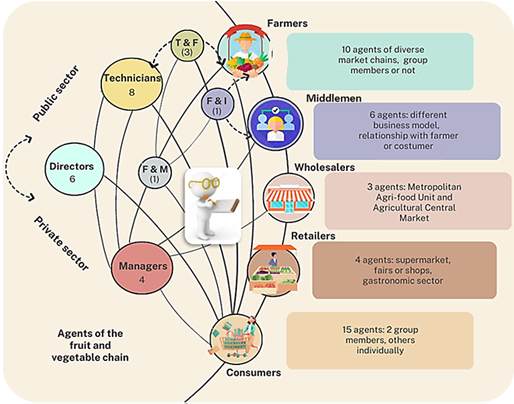

The selected methodology allowed us to “build an image” (Figure 2) integrating the different perspectives of the agents that interact in the fruit and vegetable chain, regarding digital innovation and the effects on the commercial sector, with consensual and conflictive aspects. The agents had different years of experience, different roles in the chain, were linked to different types of marketing system (Table S1 and Table S2, in Supplementary material) and can be described as:

I. Public and private institutions: Policies and interventions from many public and private institutions permanently affect the entire Uruguayan fruit and vegetable chain with different decision-making and levels of interaction. Some of these institutions are the Department of Agriculture of the Ministry of Livestock, Agriculture and Fisheries (MGAP), particularly the Directorate General of Farm (DIGEGRA); the National Agricultural Research Institute (INIA); the referent public agency for land policy, Instituto Nacional de Colonización (INC); the institute for extension, technology transfer and training, Instituto Plan Agropecuario (IPA); the National Research and Innovation Agency (ANII); the department of social development of the Ministry for Social Development (MIDES), the public universities, Universidad de la República (Udelar); Universidad Tecnológica del Uruguay (UTEC), Universidad del Trabajo del Uruguay (UTU); the public bank Banco República (BROU); as well as private banks, other private financial institutions, research and education agencies and service companies20. Furthermore, in the digital area, the role of Antel (government-owned telecommunications company) and Ceibal (educational innovation center with digital technologies of the Uruguayan State) is fundamental.

II. Farmers are the initial link in the chain, responsible for growing fruits and vegetables in various regions of the country, using multiple sale channels. Some of them sale conventional products (using tools from the dominant agricultural model) and some produce organic products or products with some processing (differentiated products). They frequently join cooperatives or networks, such as the agroecology network Red de Agroecología (RAU)20. The main delegation of small and medium farmers is the national commission Comisión Nacional de Fomento Rural (CNFR) on behalf of Rural Development Societies, Sociedades de Fomento Rural (SFRs), since 1915, promoting the development of rural groups, cooperatives, agro-industries, productive plans, etc.21.

III. Middlemen are the ones between farmers and wholesalers, and between these and retailers. Commonly, wholesalers own the products they sell, but some group of middlemen handle large volumes of products which may or may not be their own20. These are commonly called commission agents or “brokers”. Middlemen in this analysis also were in charge of transportation, loading and unloading.

IV. Wholesalers in Uruguay are mostly represented by the current most important fruit and vegetable market in the country, the UAM (Unidad Agroalimentaria Metropolitana), previously called Mercado Modelo, governed by a co-management system (gathering representatives of the municipal government, the Ministry of Agriculture, producers, wholesalers, retailers, and workers).

V. “Retailers” are represented by supermarkets, warehouses or self-service stores and municipal fairs that sell fruits and vegetables directly to consumers20. There are also mobile markets where the seller has vehicles specially adapted to direct sales, and collective small markets or stores to present local products to those buyers who come from more distant areas.

VI. Consumers represent the final link in the fruit and vegetable chain, playing a crucial role in product demand and market trends towards diversification and quality. They are mostly represented by individuals, but in Uruguay there are also groups of consumers that come together to achieve fairer prices (such is the case of Mercado Popular de Subsistencia)22.

3.2 Innovative projects including new digital tools and marketing channels

Together with the main actors, we identified some initiatives carried out by them that articulated digital innovations with an active search for new commercial pathways for farm products. Those are described below:

At SFR Canelón Chico, since 2017, through the call for promotion and development of appropriate technologies for family farming “Más tecnologías”23, together with UTU, they created a cooperative company to supply the State with fresh and dry horticultural products, with training instances, brand and logo formulation, the possibility of integrating shorter commercial circuits, starting with the public procurement regime24. Elements are chained together to support more logical issues: website aesthetics and digital commerce platform. Marketing with the UAM was also currently taking place (many times via Instagram). In 2020, the institutional project “AgroTIC” 25) enabled one more step in technological development: they propose a test around traceability (from producer to wholesaler for bell peppers and tomatoes) with the use of QR codes. The consumer would be able to access a “field notebook” by reading the QR code (per label) that leads to a website with information on all products about the origin, sowing, harvest, conservation method, packaging, etc. The differentiation will be in the guarantee of origin.

Directo de la Granja is an initiative by two families with their members occupying different roles in production and marketing. Twenty years ago, they participated in a farm conversion plan (Programa de Reconversión y Fomento de la Granja)26 that allowed them to plant some fruit trees that are growing now. Recently (in a phase of demotivation) they began a transformation into organic production of fruit trees and orchards, focusing on direct sales with home deliveries (first through WhatsApp, Facebook, and Instagram) and improvements in sales management, with an investment in a website that simplifies the receipt and organization of orders. The members believe that attending the marketing or communication area is not easy for those in charge of production or distribution, but they feel satisfied and proud. Their key is to reach the market in Montevideo and offer healthy products that people are willing to pay more for. They would like to have more support or advertising.

Ecomercado: Owned by a family of horticultural farmers who, in 2009, decided to change their system, joining a group of agroecological producers from the Villa Nueva Development Society (in Sauce, Canelones). They began selling fruit and vegetable baskets to families: from 6 daily deliveries, they grew to 800 in times of pandemic. They established a store in Montevideo27 and their evening fairs, becoming a marketing channel that moves large amounts of merchandise in a planned way. Through WhatsApp, they offer weekly a list of products and baskets. Many times, they have the job of communicating about the seasonality of production and the benefits of organic food to curious people. At present, they focus on maintaining their current customers with small gestures of personalized attention (and getting some new ones by recommendation).

SFR CAVA is a cooperative society of 23 winegrowers from Canelones. It started in 2016 intending to improve grape sales conditions by having a common winemaking project. They have a door-to-door marketing channel which succeeded in the pandemic through telephone orders and WhatsApp. Members also have other sales channels (fairs, private events, and some supermarkets), and export together to Brazil through agreements between cooperative societies. Today, they want to build a more extensive commercial circuit in the domestic market and aim for relations with other cooperatives for export, for which they consider that developing a recognized brand is important. Thus, they began an advertising campaign on television and other media.

Agricultural cooperative Mercado Agrícola Familiar de Cerro Largo28 was founded by 7 farmers who deliver their products to their store, which also offers other local products from the area. They also provide to the mayor’s office, childcare centers, and retailers (warehouses). Customers arrive through word of mouth and social networks (Facebook). They take orders through WhatsApp and have a delivery system. The success of the marketing program attracts greater demand that is not yet met by their local production capacity (which is considered a problem by farmers). Currently, despite having developed a packing, washing, conditioning, and classification system with funds from a project by the Ministry of Industry in 2020, they need investments to face climate problems and to produce more, which is why they are competing for financing from INACOOP29 to strengthen horticultural, beekeeping and poultry production, and the artisanal production of cheeses and jellies by women.

Punto Verde Orgánicos is a cooperative run by 11 families since 1991. In 1995 they received a proposal from the supermarket Tienda Inglesa to produce organic products. Since then, they adapted and regenerated their products according to the environment’s possibilities. Today they deliver through three sales channels: Tienda Inglesa, vendors and basket sellers, and the web application for food delivery PedidosYa. Producers have the freedom to sell separately through different channels. At the same time, they have a small laboratory (financed by ANII 8 years ago) for the reproduction of fungi that control whiteflies30. Orders are often taken via WhatsApp. They participated in a project to increase sales through social networks but today they use them more to promote the brand and continued awareness, not necessarily for sales. They would like to gradually implement more technology in the productive sector to reduce labour (automate greenhouse management and irrigation), and to simplify the management of orders from fairground vendors and basket makers using spreadsheets or web applications to track sales and improve efficiency.

SFR Colonia 18 de Julio: Born in 2018 from the union of four rural societies, through a MGAP project, to sell to public institutions under the public procurement regime31. In 2019, through the national food institute INDA, they began to supply 19 institutions, reaching more than 100 (hospitals, childcare centers, municipal soup kitchens, etc.) in Salto, Paysandú, Artigas, Tacuarembó and Rivera. They manage fruit and vegetable orders by spreadsheets and maintain WhatsApp groups with farmers from the 5 departments to combine offers. They also reach agreements with farmers in the south to diversify products. They believe that the business is at its maximum logistical capacity today, but they are considering the possibility of incorporating certain processing of products (chopped, washed products, etc.) and investing in management software, as it is demanded at the purchasing centers.

Centro Emmanuel is a non-profit demonstration farm for the promotion of agroecology. There is an intensive use of technology for communication through social networks and the website. Some partner farmers tried direct marketing with enthusiasm and will, and then expressed they got tired from overwork. In their opinion, since the market is limited and there is a lack of coordination, due to over- or underproduction, they end up selling to traditional channels that do not recognize the value and become discouraged.

Punto Natural: During the pandemic in 2020 (having identified a special need), “Punto Natural Home” emerged with a successful home sale of baskets and they immediately opened a physical store, but today demand is decreasing and they consider that this model complicated operations of their original business. Then, they re-defined themselves as a logistics center: they buy fresh products exclusively from UAM, storing from one day to the next, packaging and distributing under a pre-sale system (taking orders the day before). The company continues to grow, with reforms at UAM and focused on supermarkets. They understand the importance of professional advice and new points of view to incorporate into the business.

Orgánicos Delivery is a marketing service linking agroecological farmers and consumers. They communicate through social networks (WhatsApp and Instagram), add content, and offer technical and commercial advice if needed. The link with farmers is very close so that they can explain the processes to the consumer very well. Their most important job is to transmit the importance of consuming agroecological products and the value of local commerce. The pandemic positively impacted the business in terms of capturing people’s interest. Today, the price of petrol means that operating costs are high for them and, based on that, they sustain that it is necessary to attract more customers and keep the regular ones. They are joining new social media (TikTok) and want to incorporate an online store.

Rural Commerce is a digital technology company for business management. Based on objectives and planning, projects are co-constructed with farmers. They consider the farmer as the protagonist, aiming to democratize technical service (avoiding transportation costs) and promote digital literacy. Connection with farmers happens through projects, public institutions, or international and civil organizations. The cooperative network also helps to attract customers. In Uruguay they participated in Mercosur courses32 to design innovative models for rural women, they worked with a development commission, and also in basket sales initiatives and workshops.

Granja Mibro: The business grew especially during the pandemic due to a special concern about their diet and door-to-door delivery (from José Ignacio to Piriápolis in Maldonado). Sales are handled mainly through Instagram and WhatsApp. In 2021, they opened a store where they also resell products and receive other agroecological producers to exchange experiences. Workshops and spaces for dissemination and community are generated monthly in “farm meetings.” Considering their growth limit according to their workforce and satisfaction, they handle the possibility of creating an online platform or store to serve their clients, maintaining formality and commitment.

La Micaela Orgánicos is an organic garden project with order management by email or WhatsApp. During the pandemic, their sales fell by 65%: given the economic crisis, organic was considered too sophisticated for their clients (consumers and supermarkets), who prioritized the cheapest products. Gonzalo, the owner, believes that vegetable production is a subsistence business, where profitability is given by the informality of the farmer; and he also defends that developing an organic production system requires many years of research, development, quality, and consumer understanding or education, and other factors that are not yet really appreciated.

Olla de Barro is a small business of organic meals (preparations using organic products) with a well-defined distribution, especially to families of neighbors. Online sales happen through Facebook, Instagram, and word of mouth. Their production and distribution capacity is now limited to 25 meals a day (based on what the owner and cook, who is the same person, can handle). Originally being part of La Ecotienda33, the number of clients has changed (increasing in the pandemic and then stabilizing), but their customers have maintained loyalty for more than 10 years.

Arazá: Restaurant in Montevideo that rescues the value of native and organic products, after receiving a competitive fund from the Ministry of Culture34 for the project “Al sur de Uruguay: el sabor de lo nuestro”. The main cook and owner insists on good and close relationships with farmers for fair prices for both parts, as she claims that regulations do not fully consider small and medium companies. Her business suffered the economic recession of the pandemic: they closed for 4 months and started delivering food directly to homes. They also carry out other activities to improve profitability: talks at study centers; and organization of corporate events, weddings, birthdays, etc. Part of the job is to educate so that customers value their products and ask for them. They demonstrate a very strong commitment to the environment.

3.3 Identification of strengths and opportunities for digital innovation in the fruit and vegetable chain

These initiatives and others, which were discussed, allowed the identification of strengths and opportunities in the current fruit and vegetable commercial sector for digital innovation:

3.3.1 Strengths

Incorporation of some digital systems that facilitate crop management and allow the saving of resources.

New successful marketing strategies in cases of differentiated products, especially organic ones.

Cases of direct sales from the farms that began with the 2020 pandemic, spreading through social networks.

Cases of group marketing through social media (WhatsApp or Instagram) by horticultural producers.

Order management through spreadsheets or web applications for vendors and basket sellers that allow sales to be tracked and improve efficiency.

Generation of online memberships to maintain customers and avoid price flows.

Technical and commercial advice via web or through social networks, allowing more access given a reduction in transportation costs.

Mailings, brochures, and social networks are beneficial for supermarket advertising every week.

Among farmers, simple technologies have had a great impact: for example, WhatsApp audio is a good communication tool for low-literate people. It has allowed easy dissemination of events and even legal information more effectively by avoiding transfers, etc.

Mediation of policy meetings (Development boards and Global cooperative forums) via Zoom has increased participation and was essential during the first outbreak of the pandemic. They are also considered more economical and environmentally friendly.

In Uruguay, bureaucratic and democratic processes sometimes guarantee more equal participation and more transparency in the processes.

Information system of prices for the final consumer and farmers in the UAM, which pretends greater transparency of prices and negotiation capacity (mainly for producers with intermediaries).

In Uruguay, there are groups of people aiming to collaborate and cases of new consumer networks that are forming and stabilizing based on their local markets.

Use of public policies’ instruments to start some projects.

3.3.2 Opportunities

Predisposition of some people to the use of digital technology and to opt for alternative marketing channels.

New opportunities for the youth to develop their potential in the sector.

Generate trust networks without needing technology, but using it as a tool, given the size and educational level of our country.

Arrival of web transactions, the use of crypto currencies and traceability for the sale of farm products (with the 4th and 5th digital revolutions), and a growing digital government.

Small and growing population of consumers who want to get closer to farmers, willing to pay more for it.

Possibility of using software for automatic remittances and the generation of invoices.

In supermarkets, technology can facilitate making decisions based on stored data (to plan logistics for upcoming seasons). It may also offer advantages in terms of hygiene and safety, and purchasing management with the wholesale market.

The press as an ally in the success of initiatives through broadcasting on television, radio, newspapers, etc.

3.4 Current problems and challenges for digital innovation in the fruit and vegetable chain

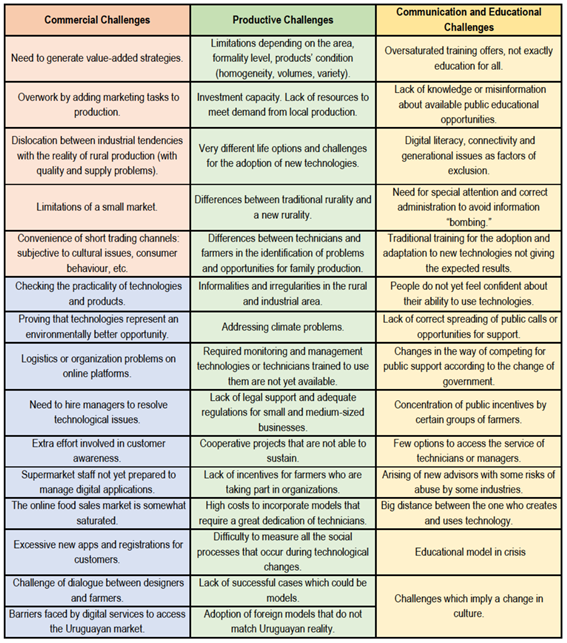

Challenges came up together with the opportunities we identified (Table 1), enriching the analysis of the sector. Those challenges were related to some basic problems of the commercial sector identified by the main actors:

Limited domestic consumption of fruits and vegetables, and very little export; little possibility of competition in the region due to high costs (fixed, fuel, etc.) and climatic factors. Very high product prices for the gastronomic sector that aims to add value.

Difficulties in presenting and communicating the added value of products to the consumer understandably and attractively.

Difficulties for farmers to cover logistical costs at the wholesale system.

Decoupling between existing capital supply and projects seeking financing.

Concentration in the market by those with more production capacity. Concentration of public incentives by certain groups of farmers, who are the most involved and disposed of and have greater access to technicians.

Complicated rules imposed by industry or the State when trying new commercial channels.

UAM poorly adapted to the reality of small producers and retailers. Need for more transparency in the first step of price surveys (from UAM operators).

The work of the middlemen is commonly trivialized.

Managers as an option for collaboration and support in the processes, but not everyone can access their services.

4. Discussion

4.1 Main actors of the fruit and vegetable chain

The use of soft systems methodologies13 allowed us to represent some complexity of the relationship between the actors involved in digitalization processes in the fruit and vegetable commerce, with interactions in many ways and shared roles between them.

We could appreciate that some actors occupy more than one role in the fruit and vegetable chain at the same time (for example, being a technician and a farmer as well or a farmer and a middleman) and use various market channels20: offer more than one “type of product or service” to more than one “sales destination” (Table S1 and Table S2, in Supplementary material).

Figure 2 also shows the role of researchers as participants who must be considered in the analysis since they will inevitably bring subjectivities to the situation of study14.

Therefore, opinions come from the complexity that people have in their different roles, with the expected appearance of tensions and contradictions at different moments of the participation-action research process 17)(18) 19. We consider that these opinions qualitatively enrich the debate and knowledge about the sector.

4.2 Innovative projects including new digital tools and marketing channels

In this sense, when discussing innovation, we could appreciate that the Fourth and Fifth Industrial Revolutions are having a significant impact on rural Uruguay. Digital technology is providing new tools for fruit and vegetable marketing, like electronic commerce platforms; mobile applications (including functions such as purchasing products, scheduling deliveries, and managing orders); labeling and traceability technologies (allowing consumers to access detailed information about the products they are purchasing), etc. These advances, previously described 3)(6) 35, are trying to help producers, distributors, wholesalers, and retailers adapt to the demands of a changing market.

Delving into the commercial sector of fruits and vegetables, other studies in the region agreed that, since 2020, there have been events that opened horizons towards new commercial channels due to greater awareness about food consumption36. Regarding marketing channels, they also reported a consumer inclination to know the origin of the products and to buy them through social networks or websites37, as well as the development of solidarity and sovereign forms of food supply through social organizations38. According to Impulsa Industria39, with the arrival of the pandemic, 36% of the Uruguayan population changed their consumption and food preparation habits, with a leading role of local stores, but currently, 13% of them returned to the former situation of consumption.

Similarly to our study cases, many horticultural family farmers from Mar del Plata, Argentina, pointed out the positive impacts of the pandemic on the development of their activity (related to the increase in sales, agroecological transition, the incorporation of new consumers and the growth of home delivery). However, there is a small group of those same farmers who experienced negative changes in the development of their activity, generally due to problems in the supply of inputs and limitations in circulation in the case of informal situations, which makes visible previous contexts of vulnerability37.

4.3 Strengths and opportunities for digital innovation in the fruit and vegetable chain

In the dialogue spaces, we were able to share with the actors the lists of what were considered the most important achievements and the most promising opportunities for their innovations. However, the greater impact (pointed by them) in all the cases was of communication technologies allowing rural farmers to establish direct communication with consumers and suppliers through text or voice messages, emails, electronic forms, calls (or video-calls), and newsletters. These allow them to share news about their production, special promotions, and agricultural events, as well as receive feedback from customers, similarly to what is expressed by Hassoun and others 8)(9) .

When we discussed support issues, they stated that contributions to their progress came from both private initiatives and public projects. The State has been active through, for example, the IPA, a pioneer in online courses and calculation tools for the countryside; Ceibal, which strengthens high-speed connectivity in rural educational centers and offers educational programs (such as “computational thinking” or “young people to programming”), sometimes together with INEFOP (national institute of employment and training) and MGAP. In addition, the new call Senda Agroecológica40 focuses on providing technical assistance to promote proposals for agroecological transition; and AgroTIC25 was a call for projects for the development and/or adaptation of existing digital solutions to problems linked to family production that aims to partner with private development companies and/or teaching entities with proven experience in the subject.

It is also important to mention how relevant the public procurement regime 24)(31) , from family farmers to public institutions, was to the sustainability of the fruit and vegetable chain, especially for small and medium-sized family farming businesses. This public policy instrument has allowed farmers to keep their business by supplying to several institutes and social programs.

4.4 Current challenges and problems for digital innovation in the fruit and vegetable chain

When we delved deeper into the challenges they had identified, participants explained:

- Not all the actors are ready or trained. “Even if you have access to technology, being able to use it can be hard. If it is too complex, old methods end up being more effective”, they express. However, one of the interviewees explains: “Digital technologies have such a broad impact that not using them means being left out of a society, not just a sector: giving up computational knowledge today is equivalent to giving up reading, comprehension, and mathematics knowledge in the 17th century.” One of the barriers to adoption could be the educational level and average age of Uruguayan fruit and vegetable growers (55 years and incomplete secondary education according to the national census)41, since research shows that older farmers tend to be more conservative and less likely to adopt technological innovations compared to younger producers42.

In this respect, some intermediaries realized that new tools for measuring results (profitability, margin, suppliers, shrinkage) in supermarkets have left out some possibilities of compliance for farmers and that there is a competitive gap between supermarkets and specialized stores that do work with trained people. Similarly, Gallardo-Cobos and Sánchez-Zamora describe several obstacles and risks caused by a divide in the digitalization processes in Spain10.

- Actors also mentioned cases of web pages designed to simplify orders that have sometimes made the sale of fruits and vegetables more complex, identifying that some initiatives make an impact at special moments but do not always remain. In this sense, the online food sales market was a way out of the emergency of many people in 2020 in Uruguay, but not all were sustained39.

- Technicians believe that applying a certain “marketing” mentality to meet consumer interest needs more market studies for the sale of horticultural and fruit products through social networks and other means. Also, communicating the importance of consuming fresh products (which in Uruguay is less than what is daily recommended by the World Health Organization)43, and supporting Uruguayan families who are committed to fairer economies. At the same time, there is a need for special attention and correct administration to avoid information “bombing”.

- According to the interviewees, interesting offers for farmers in terms of training should consider the particularities and preferences of different groups or individuals, open the way to dialogue, allow the most basic questions, and present innovations with respect. On this topic, professionals said: “We need to show that technology is already part of life, that it is being improved with experience and scientific knowledge. This generates an opening towards digital literacy. We need to promote curiosity”.

- According to public workers, it is necessary to stratify and learn more about family production because the realities are very diverse (in terms of production sector, socioeconomics, etc.). There are different perceptions of the risk of change and differences in starting points depending on education level, age, gender, etc. For example, in Rocha and Maldonado departments, there are territorial conflicts between traditional rurality and a new one that appears due to independence from their workplaces (facilitated by teleworking) with very different objectives. We can see people using web transactions, crypto currencies, etc., in rural areas, while there are still people who do not use televisions or computers. There is even now a lack of electricity in some zones despite being close to cities, often related to topography; and communication problems have been reported even in front of urgent complaints such as statements of domestic violence.

In this sense, actors observed a paradoxical “lack of information in a scenario where we are all connected” and the need for more honest dialogue between the government and the productive sector, and between farmers and industries to improve the situation for everyone, reflected in the wholesale market and the country's food sovereignty. According to them, policies should focus more on the differences, considering the adaptation of projects to the realities inside the territory. These same aspects were considered in the proposals of the main international events in Latin America and the Caribbean, during the International Year of Family Farming in 201444.

- Besides thinking about the distribution of roles, they believe it is important to define a goal for institutional strengthening (such as better access to the market) so that MGAP can provide the support to access technology and channels that can meet licensing requirements. Suggestions were given in the sense of promoting dynamism (being able to operate with the resources that exist) and connecting with public companies such as Antel. For that, data from the 2023 Census would help to start accounting for the problems of connectivity in the territory45.

- Also, opportunities are presented in the private capital market that farmers may gain knowledge about, and entrepreneurs can learn about the opportunities that the fruit and vegetable sector presents. However, technicians suggest that “to gain project support at the private level, there must be chemistry between investor and entrepreneur: the strategy is not so clear, and there is a lack of successful examples of impact investing instruments which recently arrived in Uruguay”.

- MGAP support would also be fundamental to prevent the arising of new advisors with some risks of abuse (as it happens sometimes in the commercial sector). For that, directors suggested maintaining face-to-face attention, enabling cost-free rapprochement, and generating trust. Similarly, the support to reduce costs or maintain technical-producer relationships in the territory, with the incorporation of experts from the social area or better coordination with educational institutions with a track record in technological change.

Within this context, farmers suggested that co-innovation projects46 have allowed a franker dialogue between technicians and producers, enabling possibilities for change. In the process, the assessment of the technical contribution of farmers is very important.

The case of AgroTIC project25 can also be an inspiration and must be evaluated. One of the public workers explained: “It is hard to measure all the social processes that occur during technological changes but, at the same time, achievements must be translated into economic resources”.

- Apart from that, wholesalers believe that investments in Central Hortícola (which is being completed due to the impulse of the horticultural unions of Salto and public support) would allow some decentralization of the wholesale market47. Farmers also claim more technology in every step of the UAM information system (transactions, quantity, and price), and see the advantage of collective actions for better opportunities to place their products.

- Finally, actors come to an understanding of the importance of generating the popularization of technological findings in communion, spreading scientific culture. “To draw upon science generates empowerment by being able to make more realistic decisions in daily life, for example, regarding food consumption”, said one of the participants from INIA. They also believe in keeping the value of direct interaction to generate other spaces and trust beyond technology, balancing different forms of communication.

5. Conclusions

Soft systems methodologies, including a participatory-action research process, enabled the integration of the different perspectives of some of the main agents in the fruit and vegetable chain (farmers, intermediaries, wholesalers, retailers, consumers, private and public technicians) regarding digital innovation and the effects on the commercial sector. To generate deep dialogues, combining the selected methods was essential to create spaces with a high level of trust. The appearance of consensual and conflictive aspects was expected since agents had different years of experience, different roles in the chain, and they were linked to different types of marketing systems.

The analysis of initiatives which include digital innovations allowed us to identify some strengths and opportunities related to the predisposition of some agents, generation of networks, incorporation of some digital systems, new successful marketing strategies, etc. These advances are trying to help producers, distributors, wholesalers, and retailers adapt to the changing market demands.

However, participants of the fruit and vegetable chain still face problems of digital literacy, connectivity, and generational issues, which can be factors of exclusion in current times. They also identify a dislocation between industrial tendencies with the reality of rural production (with quality and supply problems), difficulties in presenting and communicating the added value of products, and limited domestic consumption. The pandemic created some events prone to generate movements for innovations, some of which started from an accentuated vulnerable situation. Both successful (in the majority) and failed cases were recognized.

Regarding mechanisms of support, many initiatives or innovation projects come from the determination of families, individuals, or small groups, linked sometimes to public projects. In this sense, there is a claim for more support especially on the availability and suitability of training offers, on the articulation with other institutions to solve the problems of connectivity, and on strategies to generate a more honest dialogue between the productive sector and industries. In this sense, there are opportunities for some decentralization of the concentration in the wholesale market, and there are very interesting public and individual initiatives to be evaluated and followed as examples and motivations for the rest of the chain.

To avoid the observed “lack of information in a scenario where we are all connected”, actors came to an understanding of the importance of generating communion, scientific culture, and popularization of technological findings, together with maintaining the value of direct interaction to generate other spaces of trust beyond technology.

Finally, this study and other future studies must advance in two directions: i) on a bigger scale, continuing to account for the available support mechanisms for innovation (especially those that are emerging), and how to make them known and used by the main actors of the fruit and vegetable chain so that they are truly integrated into technological advances, avoiding the exclusion of the most vulnerable sectors; ii) on a smaller scale, following the progress of successful cases and understanding their mechanisms as well as the ways in which they can have an impact at the regional level.