Introduction

Access to oil reserves has decisively conditioned wealth and power of nations over the last century. In this context, oil trade has become a strategic asset not only for countries to obtain monopolistic income - as, for instance, a result of OPEC policies to manage production - but also to direct exports to markets that play a key part in their global value chain and, most importantly, to countries that pose as a political friend or with an unquestionable neutrality. As Dajud (2013) points out, beyond the confines of the gravitational model, factors such as culture, history, and internal similarity directly influence international trade. That is to say, the presence or absence of common interests among nations can delineate the level of trade exchanges that exist between them, especially during periods of instability.

Political alignment becomes, then, an essential feature to enable countries to stand as a preferential destination of oil products. Historically, Russia’s energy foreign policy towards Europe has been marked by the securitization of energy interdependence (Aalto et al., 2014). Recently, the Russia-Ukraine conflict makes clear that trade restrictions become a crucial measure to discriminate against countries that oppose Russian actions. The reactions to the conflict have occurred at both ends of the trade flow: historical adversaries (namely, the US) have banned all oil imports from Russia; and Russia has cut supplies off to countries (e.g., Poland) that adhered to Western complaints. In any case, the redirection of exports privileges importers that do not vote to condemn Russian actions. This is because the ability that most of the oil-producing countries have to leverage their geopolitical alignment in crisis periods to seek gains out of international reordering tends to determine the maintenance of the government or its collapse (Leon and Larratt-Smith, 2022).

Therefore, the objective of this paper is to assess changes in Russian oil exports, especially concerning its main partners, because of the trade restrictions related to the Russia-Ukraine conflict. Despite its essentiality, crude oil and fuels can be directed to specific markets not only based on traditional gravity variables - such as GDP and distance - but also considering convergent political beliefs and practical political stances in multilateral organizations. We argue that political proximity between Russia and its partners has become a crucial feature to explain preferences of destination of oil exports and has carved out some fundamentals of new directions for a multipolar political power structure, ratifying the political antagonism between the US and Russia and strengthening trade ties of Russia with China and India. The strategic realignment of international relations in response to the pressures of the Russo-Ukrainian conflict, thus, intensifies the global transition towards a new equilibrium of the system, in which emerging actors consolidate their influence in the balance of power and gradually dissolve the unipolarity previously exercised by American hegemony (Muzaffar, Yaseen and Rahim, 2017).

In methodological terms, we respond to our main research question, related to the role of political alignments on oil trade, by examining the nature of political ties of Russia and its allies and by searching for adequate measures of political distance and their respective impact on oil trade diversion. The rest of the paper is organized as follows: Section 1 deals with some intuition behind the relationship between international relations main theories and the characteristics of the oil international market. In Section 2, we analyze basic evidence on Russia’s production and exports of oil, and we relate that to the recent events of the conflict. Section 3 focuses on the main evidence, bringing up our political proximity measures and how they affect Moscow’s trade choices. In Section 4, we make concluding remarks.

1. Geopolitical traits of oil: a brief theoretical background

In this section, we present interpretations of the international oil market from a perspective of the main theories of international relations in order to comprehend Russia’s trade choices in the context of the ongoing conflict in Ukraine. Different specificities of the oil market condition stand as a drawback to classical theories, therefore we add to traditional contributions the notion of weaponized interdependence and the complex interdependence approach. Hence, we assume the hypothesis that commercial interdependence among countries does not necessarily reduce the potential for conflict; rather, in conflict situations, these interdependencies are exploited as tools to achieve foreign policy goals.

Oil production cutbacks and price discounts to preferential partners have been regular measures of large producers exercising market power. Such measures become typically more frequent and pronounced in times of war with significant geopolitical consequences. The natural concentration of reserves of a key mineral resource favors a scenario of international shocks that are inherently asymmetric, causing trade deterioration and energy dependency, on one hand, and income gains and increase of state power, on the other. Structural conditions of the oil sector around the world include scarce possibilities of oil substitution, an oligopolistic global value chain and a collusive practice between multinational corporations and governments. These three characteristics imply a complex relationship between states in the context of international markets, which can lead to the use of oil production and exports as a weapon by large exporters, especially when countries - and particularly those with global or local political power - are involved in war (Farell and Newman, 2019).

Supply controls of strategic goods become recurrent events especially in times of war. A well-known example refers to the Allied control of Spain’s oil exports to Germany during the Second World War. In a historical analysis of these sanctions, Caruana and Rockoff (2007) conclude, however, that policy coercion was effective only when a total embargo was in place. Reduced export restrictions proved to be less successful in reversing Spanish position favoring the Axis.

Regional crises such as the Gulf War and the Russia-Ukraine conflict highlight the use by belligerent states of the control over oil supplies as means to inflict damage on their adversaries and, as a consequence, to achieve political goals (Labelle, 2023). Therefore, the experience of previous global and regional military conflicts have taught us that both political and economic aspects must be taken into account to comprehend the role of energy inputs demand and oil supply to comprehend the contemporary international political economy. In addition, the extent of trade sanctions aim to minimize the economic effect on the exporting country and to maximize the political impact of oil shortages in the adversary country.

As for a theoretical background of these policy actions, traditional international relations’ theoretical perspectives have been depicting some critical characteristics of the oil sector. When it comes to its structure, Jeffrey D. Wilson (2019, p. 115) argues that, “from an international-political standpoint, there is a perennial tension between consumers and producers”. The former actor seeks lower prices and secure supplies, while the latter aims higher prices and rents due to maximum profits along the oil value chain. Such conflict can lead to tensions where states deal with international diplomatic negotiations and even with regional wars to secure access to oil resources and related infrastructure. Therefore, idiosyncratic economic and political characteristics provide a particular structure for the international oil market, which we briefly analyze below based on the two mainstream international relations theories (Realism and Liberalism).

Realism tends to view the problem posed by the oil market from a geopolitical perspective, in contrast with Liberalism that looks at it as a governance issue (Wilson, 2019). The Realist theory suggests that one can comprehend the intricate chain of global oil industry by looking at the competition among states for access to oil resources and, therefore, naming it an access-based view, as Michael Klare (2008) points out. This view highlights oil as a scarce and strategic good for both economic and military uses, pointing out the importance of controlling its extraction, production (e.g., fuels) and distribution, since oil becomes a mechanism of foreign policy (for states, representing large multinational corporations interests and their owns) and an asset that yields either consumption security or a potential welfare threat.

On the other hand, Liberalism suggests that the structure of the oil market can incorporate mechanisms of cooperation since very few states have the complete production chain of oil and its derivatives, and market volatility can be a significant cost for all. This makes it difficult for investment projects and consumer access. As Goldthau and Hughes (2020) summarized, cooperation can be fruitful for information sharing, settling expectations and defining policy standards in the energy sector, not extermination space for conflict, which will be addressed by international institutions. In this sense, states have a high collective action incentive to cooperate, which is empirically verified by institutions such as the Organization of the Petroleum Exporting Countries (OPEC) and the International Energy Agency (IEA). The Liberal theory also emphasizes the role of the market in shaping the global oil industry, with supply and demand determining prices and production levels.

In a Realism perspective, Wilson (2019) describes oil access as the key feature of energy security. From the consumers’ point of view, a nation experiences a threat of survival if it depends heavily on oil imports; while from producers’ standpoint, mastering oil production molds a strategic position of coercion which makes the possibility of setting up oil as a weapon a policy that is politically and economically feasible. That dichotomy spurs a conflicting scenario that depicts a zero-sum game where Nations securitize their relations concerning energy issues. states, according to Balmaceda (2018, p. 132), seek to intervene in the energy sector in order to guarantee control over supply sources and different layers of the industry value chain, so that private and government interests interchange and the state increases its power on a global scale. Regional conflicts and even local wars become a more likely outcome, under the Realism approach, whenever there are significant oil rising prices and supply shortages, especially when those are related to border problems.

Divergently, Liberals argue: “energy is a potentially cooperative international domain” (Wilson, 2019, p. 116). Indeed, they assume that market conditions (supply and demand), technological innovation and institutional networks - that express oligopolistic power, consumer preferences and special trade arrangements - signal and encourage nations to form a cooperative sphere through a globalized energy market. states, in turn, lose power in the input policy by positioning themselves in a more pluralist space, with direct action by private institutions and initiatives in the established free market. However, the liberal situation does not end the probabilities of conflict, but stipulates ways to reduce them by guaranteeing the efficiency of trade and, consequently, encouraging the building of a global energy regime. Realism and Liberalism yield different perspectives concerning the role of the state in the oil and gas international market. The main difference refers to energy interdependence being primarily a source of conflict or interstate cooperation.

Beyond these two mainstream theoretical approaches, there are other attempts that tackle the problem in a more empirical and critical fashion. The political determinants of international trade is the cornerstone of the reflections in the field of international political economy. The interpretation of how trade relations work and, most importantly, how states influence the structure and the functioning of the markets are key aspects to comprehend the role of states to the oil international market (Mansfield and Mutz, 2009; Alt et al., 1996).

Recent research has been built upon these latter perspectives to approach the ongoing Russian-Ukraine conflict. Farell and Newman (2019) build a network analysis that develops the concept of “weaponized interdependence”, where the authors argue how states are able to “leverage interdependent relations to coerce others” (Farell and Newman, 2019, p. 45). They point out that the international system works as a network, where actors are the nodes connected to each other by a series of ties, “which channels information, resources and other kinds of influences”. The degree of the node is higher when it develops more ties with other nodes. In this perspective, ties tend to connect nodes that already have a larger number of other connections, creating hubs - which are central nodes through which the majority of ties are linked. On the international system, states could explore those hubs in two different ways: in order to gather information or to restrict the access of other states (chokepoint effect). Therefore, states that have control over central nodes in the global networked systems have a distinct advantage in imposing costs to other entities. With the right domestic institutions, they can use networks to collect information, disrupt economic and information exchanges, identify and exploit weaknesses, enforce policy changes, and discourage undesirable actions (Farell and Newman, 2019, p. 46).

Labelle (2023) builds upon Farell and Newman’s notion of “weaponized interdependence” in order to analyze the last 50 years of the oil and gas markets and, particularly, the Russia-EU relationship. They argue that the growing interdependence fostered by liberal trade policies provided the base for oil and gas to be “international weapons”. For them, the dependence of Russian oil and gas stressed the high level of economic vulnerability of countries in Central Europe. However, the European Union took actions to impose sanctions and price caps on imported energy inputs from Russia, and, therefore, to attempt to reduce the revenues of oil and gas exports, impacting petrostates’ finances (Labelle, 2023, p. 542-543).

In this context, a “black-and-white perspective” has marked the trade of oil and gas between Russia and Europe, where often geopolitical interests of both parties transform the economic and regulatory regime into a tool of energy statecraft (Labelle, 2023, p. 544). It is worth acknowledging that states directly use foreign policy (e.g., quotas and preferential prices) to discriminate markets and that they indirectly employ government investment and subsidies to oil companies (frequently state-owned companies) to build up international value chains that strengthen trade links to specific regions and countries. Therefore, the key role of oil in industry and the strategic position of Russia to the Central-European consumption market of energy inputs condition how disruptive economic restrictions and political effects of the Russia-Ukraine conflict can be. In a recent study that analyzes the conflict in Ukraine, Walt (2022) points out the need of theoretical innovations to comprehend the vast political spectrum of this conflict. He agrees that Realism has been the most successful perspective to understand the nature and the implications of the conflict, but he also reckons that it hardly tells the whole story. There is room to assess the hypothesis of weaponizing oil trade both as a supply-driven strategy of Russia, for instance to benefit friend countries, and a demand-driven policy, where foe countries ban Russian imports. Therefore, in this paper, we examine the reaction of the Russian foreign policy to trade restrictions imposed by Western nations, assuming an essential role of the Russian state that deliberately chooses to trade oil and gas with large markets that are or become politically aligned countries.

2. Russia’s oil production and exports and the conflict with Ukraine

Regarding initial insights into the impacts of the Russia-Ukraine conflict on the oil market, this section addresses specific facets of Russian oil production and logistics. It entails a chronological overview of the principal events of the conflict with respect to trade effects, a brief description of oil imports - at global level and those from Russia - and an exam of recent trends in world oil prices.

Russia assumes a pivotal role in the global energy sector, ranking as the worldʼs third-largest producer and second-largest exporter of oil, while concurrently leading in gas exports (US EIA, 2023; Review of Maritime Transport, 2022). Beyond the prominence of oil and gas in Russia’s export portfolio, notable features define the primary producers and distributors within the sector: the convergence of private and public objectives in corporate governance and the oligopolistic structure characterizing the industry.

Scholarly discourse by Henderson and Moe (2016) underscores a noteworthy concentration of gas production and exports through pipelines within Gazprom, a publicly held company wherein Russia maintains a majority shareholder position exceeding 50% (Statista, 2021). Contrary to expectations, the emergence of other entities in the sector, such as Rusneft, as highlighted by Rossbach (2018), has not instigated a discourse on liberalization because these ostensibly independent firms operate within a framework of substantial government control. The oligopolistic configuration of the Russian energy companies can be primarily attributed to their significance for the central government, particularly in the formulation and execution of its foreign policy strategy.

As for an overview of the main facts characterizing the Russia-Ukraine conflict, Figure 1 provides a timeline since the beginning of the conflict in February 2022. The reports include key episodes in the international energy market, especially those imposing substantial restrictions on oil trade.

The timeline depicts the principal actions of international actors that somehow affect the Russian energy sector during the period of the conflict. As one of the main oil producers and exporters, Russia has undergone significant economic and political impacts derived from its decisions and actions in the conflict. Commercial restrictions on Russian oil exports have been the most influential trade policy to attempt to reverse Russia’s position with respect to Ukraine. These measures ranged from constraining Russian product prices through price caps to more severe actions such as the imposition of trade embargoes.

The sanctions were initially applied by the United States, followed by the European Union, which gradually diminished its economic ties with Moscow owing to its dependence on Russian energy resources. In response, Russia adopted supply cuts, such as the suspension of oil deals with the Poland largest energy company, PKN Orlen (Hajjaji et al., 2023). Simultaneously, OPEC decided to augment its oil production by nearly 650,000 barrels per day between July and August 2022 in a gesture of relative support for allied countries backing Ukraine and to avert a potential energy crisis. However, the organization four months later decided to shorten production in two million barrels per day, introducing an additional source of instability. In addition, trade restrictions and political ties shape a new portfolio of main oil importers from Russia: notably India, which has become Moscow’s second-largest oil importer in December 2022. Moreover, certain nations, such as Hungary, maintained their economic ties with Russia, resisting Western pressures to move away from Moscow’s influence.

Beyond that, the geographical distribution of oil reserves in Russia engenders significant geopolitical implications, notably evident in its transportation infrastructure, particularly ports and pipelines that underscore Russiaʼs historical trade routes. As illustrated in Figure 2, the map delineates Russian oil reserves, principal ports facilitating oil exports and critical pipelines, notably those directed westward, serving as conduits for gas supply to Europe.

It is evident that the primary reservoirs of oil in Russia are situated predominantly in the Western Ural region, elucidating the extensive network of pipelines oriented towards Europe. The proximity of major ports to these reserves and the western expanse of the country, such as Primorsk and Ust-Luga in the Baltic Sea, Novorossiysk in the Black Sea, and Murmansk in the Arctic Sea, contributes to reduced logistic costs owing to their close proximity. In contrast, the Eastern region predominantly features pipelines directed towards China. Despite Japan receiving Russian pipelines, the geographical distance necessitates longer and consequently more expensive maritime routes to destinations such as India and China.

Additionally, a classification can be made between pipelines dedicated to gas and oil transportation. The former constitutes the predominant share of pipeline transportation in Russia, with 83% of Gazpromʼs pipeline gas exports directed to Europe in 2021 (Jordan and Husbands, 2023). The latter is concentrated in the Druzbah pipelines to Europe and the Eastern Siberia-Pacific Ocean oil pipeline to China (Heussaff, 2023). Notably, approximately 70% to 85% of imported crude oil from Russia is dispatched from its western ports on the Baltic Sea and the Black Sea, with smaller volumes from Arctic terminals. The remaining portion is conveyed through the Druzhba pipeline, accounting for approximately 4% to 5% of the EUʼs total oil imports from Russia in 2019, while pipelines and maritime transport of liquefied natural gas (LNG) represent the primary modes of transportation for Gazpromʼs gas exports to Europe, constituting 44% of the total (ENTSOG, 2022).

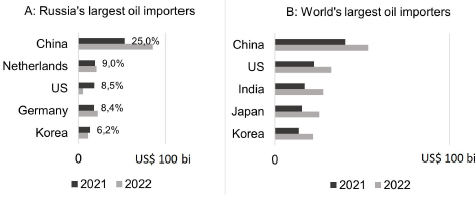

In the context of Russiaʼs influential role as an energy supplier, a comprehensive examination of the energy market is undertaken utilizing trade, export, and import data for the generalized product under HS code 27 - mineral fuels, mineral oils, and products of their distillation; bituminous substances; mineral waxes. Employing data from 2021 and 2022, an empirical analysis of dollar imports from the top five destinations of oil from Russia and from the world is conducted. Furthermore, the indexed percentage provides a more elucidating depiction of each country’s individual contribution to Russiaʼs total exports in 2021.

The global trade of mineral fuels and oils reached approximately 2.345 billion dollars in 2021, with Russia contributing 9% to this value (Comtrade, 2023). Figure 3 endeavors to ascertain the degree of alignment in terms of destinations for Russian production with the overall global trade volume, revealing three pivotal countries - China, the United states, and Korea - that emerge as key players in both contexts. Consequently, the strategic importance of major oil-importing economies becomes apparent, underscoring their role in influencing Russia’s export dynamics. This market analysis, encapsulated too in Figure 2, underscores the significance of geographical location, access and energy interdependence in shaping Moscowʼs trade partnerships prior to the commencement of the conflict with Ukraine. Notably, two European states, namely the Netherlands and Germany, feature among the top five destinations for Russian oil, but are not prominently represented in the global context. It is worth noting that these two countries experienced a small increase in imports in dollars, which can be explained by an increase in oil prices.

Additionally, an exploration of the repositioning of major global actors in the energy market, particularly the United States and India, assumes significance from a political standpoint, particularly in 2022. This realignment may be associated with the imposition of economic sanctions and the forging of new trade agreements. Moreover, it becomes apparent that Russia exhibited a pragmatic approach concerning the destinations of its oil exports before the conflict, prioritizing logistical ease and proximity to facilitate energy trade.

Finally, the oil price emerges as a crucial barometer of the conflict and any event affecting the product’s production or transportation sectors. Figure 4 below presents a period spanning from February 24, 2021, to February 27, 2023, encompassing 253 daily Brent oil price quotes both before and after the commencement of the Russia-Ukraine conflict on February 24, 2022. In the pre-conflict period, the average price stood at US$ 74, with a standard deviation of 8.9. Subsequent to the conflict, the overall period saw an average price of US$ 97, accompanied by a standard deviation of 14.5. The discernible impact of both the initiation of the conflict and the imposition of commercial bans on Russian oil imports from Europe is evident on the international oil price: the conflict in Ukraine precedes a substantial spike in prices, instigating a more volatile and elevated price average. Although prices began to normalize after the EU ban, the new equilibrium reflects a higher and more fluctuating average price.

3. Russia’s political proximity and energy trade orientation

Trade preferences regarding partners may be a result of a strategy to search for quality inputs, large markets and technology absorption. Besides, they can be a consequence of trade restrictions (or privileges), which in general are due to bilateral or regional agreements, but could also be a result of some convergence or divergence in political standpoints. Stiffen tariffs and trade bans can deviate exports to countries that do not impose such restrictions. Additionally, political ties between countries can be reinforced by trade flows that are stimulated by government incentives - from transport infrastructure (between neighbor countries) and trade partnerships to preferential treatment in financing and investment decisions. Disruptive events, such as the Russia-Ukraine conflict, consist of actions and reactions of the states involved in the matter, often leading to extreme trade measures. Despite the key role of natural gas and oil exports from Russia to Europe, trade restrictions in the EU market redirected exports to countries with a lower reaction to the Russian position in the conflict. Nation-states that took a stand not against the Russian actions in Ukraine could probably benefit from excess supply of Russian energy exports.

To specifically investigate this relationship, one first piece of evidence regards measuring political proximity between countries. In Political Science, “Politics” encompasses institutions, resources, processes, and functions that shape power dynamics within and between states (Schmitter, 1965). Political differences across nations debate on whether politics is specific to certain societies or a universal process affecting human relations (Leftwich, 2015), and reflects convergence or divergence among actors based on ideological, partisan, and economic factors.

Political convergence is, in this context, an intangible feature that brings countries together with respect to their position regarding some of the main international issues, such as globalization, climate change, poverty and development. Political proximity also encompasses a range of collaborative activities, including trade, investment, business partnerships, and tourism. It reflects a shared alignment or similarity in policy approaches, values, and strategic interests, which facilitates stronger bilateral and multilateral relations. This convergence can be seen through formal agreements, mutual support in international forums, and general alignments in foreign policy objectives, fostering a more cohesive and cooperative international environment.

Several methods can be used to assess countries’ political proximity. In the context of the Political Science literature, this subject tackles political closeness into two approaches: first, by comparing different countries in terms of some features of their political regimes, like institutions and government functions; and second, by evaluating the structure and the ideological trend of political parties of distinct nations. Therefore, two countriesʼ political proximity could be measured by computing how different their forms of government (e.g., representative democracy or socialism) are or by evaluating how leftist (or rightist) their political parties are.

For this study, we do not aim to evaluate the different types of government or to assess the political orientation of the main parties, but rather measure the political stance assumed by nation-states through their voting behavior in multilateral organizations. The more aligned those strategies concerning significant themes, the closer these countries are in political terms. To calculate the political proximity between Russia and some other key countries, we examine their political behavior in the United Nations (UN) and in the World Trade Organization (WTO).

The first variable we use to measure Russiaʼs political proximity with respect to other countries is a comparison of their voting strategies in the UN General Assembly. The database has been provided and updated by Strezhnev, Voeten and Bailey (2023). As pointed out by Voeten (2016), UN voting data records have been used for two main purposes: to analyze group formation within the organization and to evaluate a country’s political preference. The latter purpose emerged more recently, but it constitutes scholars’ focus, mainly due to the fact that ‘there is no other obvious source of data where so many states over such a long time period have revealed policy positions on such a wide set of issues’ (Voeten, 2013, p. 62). In addition, for Alesina and Weder (2002, p. 1130), “the patterns of UN votes are highly correlated with patterns of alliances and commonality of interests”. Khan (2020) also uses the UN voting convergence to analyze a countryʼs political preference. Despite its possibilities, the author acknowledges some limitations such as the difficulties to explain the entire dynamics of statesʼ preferences, which are, for instance, due to bilateral relationships, types of regimes and need of security.

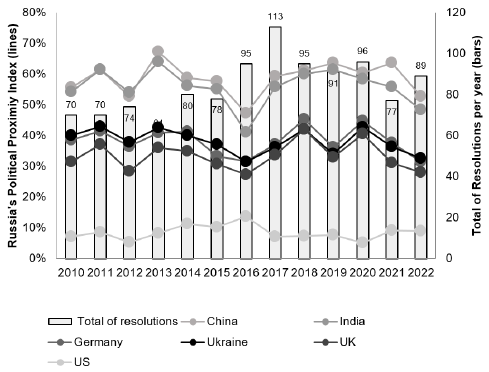

In our analysis of voting results of UN resolutions, we compare the voting strategy of Russia with a sample of countries that are closely involved in both the conflict in Ukraine and the energy market. Figure 5 shows, on the left axis, the percentage of resolutions that Russia and the other country voted “yes”, and, on the right axis, the total number of UN resolutions voted per year. The occurrence when the two countries were absent and when they both voted “no” are not relevant to search for political proximity, since the motivation behind the strategy could not be the same for the two countries.

The results indicate that the voting choices of China and India have been more convergent to those of Russia, which suggests that these two countries tend to be more politically aligned to Moscow. The votes of Germany, Ukraine and the United Kingdom show an intermediate result, where convergence with Russia is lower. At last, the US voting behavior clearly indicates no commonality of strategies with Russia.

The exam of political convergence becomes more specific with respect to the Ukraine-Russia conflict if we investigate the UN resolutions that dealt with the political reaction to the conflict. We identified seven resolutions that called for countries to condemn Russian actions with respect to the conflict. Naturally, Russia voted against all seven resolutions. India abstained in all of them, while China voted abstain (Ab) in three of them and against (Ag) in four of them.

The resolutions, in chronological order, and the Chinese position (Ab or Ag) are as follows: (1) Aggression against Ukraine (A/RES/ES-11/1, 3 March 2022, Ab). (2) Humanitarian consequences of the aggression against Ukraine (A/RES/ES-11/2, 24 March 2022, Ab). (3) Suspension of the rights of membership of the Russian Federation in the Human Rights Council (A/RES/ES-11/3, 7 April, 2022, Ag). (4) Territorial integrity of Ukraine: defending the principles of the Charter of the United Nations (A/RES/ES-11/4, 12 October 2022, Ab) (5) Furtherance of remedy and reparation for aggression against Ukraine (A/RES/ES-11/5, 14 November 2022, Ag). (6) Situation of human rights in the temporarily occupied Autonomous Republic of Crimea and the city of Sevastopol, Ukraine (A/RES/77/229, 15 December 2022, Ag). (7) Principles of the Charter of the UN underlying a comprehensive, just and lasting peace in Ukraine (A/RES/ES-11/6, 23 February 2023, Ab).

The voting strategy of India, for these seven resolutions, reveals a clearcut convergence in foreign policy between India and Russia. Despite the idiosyncratic behavior of China, its mixed positions with respect to these resolutions can be interpreted as some alignment with Russian stances and actions during the conflict. Moreover, the other countries in Figure 1 (Germany, Ukraine, the UK and the US) all voted in favor of the motion against Russia.

Hence, the commonality of voting strategies of Russia with respect to China and India on these specific resolutions also provide some insight on Russia’s political proximity. Although the reasons for China and India not to vote systematically against Russian interests may be traced back to some local regional disputes concerning these two countries, the most important outcome in terms of trade policy is the redirection of trade and the exports of Russian oil and gas towards these friend countries.

Our second variable is also related to political distance. We assume that countries that share political views and ideological standpoints are less likely to initiate trade disputes. Therefore, a measure of political convergence can be built based on the incidence that two countries are involved as complainants or respondents in panels conducted by the World Trade Organization (WTO). Countries request trade panels as they believe some other country employs alleged unfair trade actions. Politically aligned states should settle these issues out bilaterally or without WTO adjudication.

Trade disputes do not reflect only economic potential losses but also political differences. Power relations shape the participation of countries in the international trade system and may condition dispute initiatives (Davis and Bermeo, 2009). Despite some relatively high costs of entry to a WTO dispute arrangement, political and economic benefits may overcome costs. Russia has been a WTO member since 2012 and it has engaged, as complainant or as respondent, in eleven trade disputes.

Theoretically, trade dispute adjudication is often argued to be a consequence of trade interest and power. As for trade interest, high volume and diversification of trade make a country more likely to start a trade dispute. Power, on one hand, may be related to a lower propensity to dispute initiation because dispute settlement is organized in a legalized system restraining the room for bargaining (Keohane, Moravcsik and Slaughter, 2000). On the other hand, it may be associated with the fact that rich countries tend to be more successful - in terms of retaliation measures - than developing nations (Busch and Reinhardt, 2003).

In empirical terms, previous studies on countries that are mostly targets of trade restrictions (e.g., antidumping and compensatory measures) mainly focus on the exam of single countries. Bown (2010), for instance, emphasizes the case of China, as opposed to various other countries that are older members, and how it became a frequent litigant in WTO dispute settlements.

Therefore, for our second proxy variable of political distance, we compute the number of cases two countries are involved as complainant and respondent in WTO panels. We calculate absolute and relative (%) occurrences for our countries of interest, Russia, China, India, Ukraine, EU and the US. Table 1 summarizes the results considering countries in the role of complainant or respondent (not including third-party members). Notice that the number of absolute cases between two countries, measured along the column or the line, is the same in absolute terms, but different in percentage terms. The difference is due to the reference number of total cases. For instance, there are three cases of trade disputes involving Russia and the US. These three cases represent a significant 16% (column) of all cases of Russia’s trade disputes; but they are only 1% (row) of the US dispute cases. The protagonism of the US and the EU in the total number of trade disputes should not be seen as a sign of political misalignment, but rather as a result of the size of these economies and of the commercial interests of multinational corporations from both countries.

As for trade controversies between Russia and Ukraine, there are five disputes, which correspond to relatively high shares for both countries: 38% of all Ukraineʼs disputes and 26% of Russia’s. Ukraine is only seconded by the EU as respondent/complainant in WTO panel involving Russia. Interestingly, there are no disputes between Russia, China and India, which indicates that occasional trade disagreements are sorted out bilaterally and without any support of any legally binding multilateral institution.

Table 1. Occurrences of countries in WTO panels (1995-2022, selected countries)

Source: Authors’ elaboration based on raw data from the WTO (2023).

In light of our revelations regarding the political convergence between Russia, China, and India, our subsequent analysis delves into the correlation between these political affinities and Russia’s oil exports - with natural gas excluded from this analysis due to a lack of reliable data. Theoretically, we posit that political distance may not be a decisive factor in less challenging international environments but becomes pivotal during disruptive political events, such as regional conflicts and intense trade negotiations. Consequently, to scrutinize varied trade patterns, we explore two distinct sub-periods: one preceding the Russia-Ukraine conflict and another following its onset. Our primary objective, in the ensuing analysis, is to assess alterations in export destinations that are likely linked to the conflict.

Initially, we utilize volume data on oil exports sourced from Heussaff (2023). This dataset provides a monthly compilation, including metrics such as oil throughput handled by ships in selected countries. In our context, the data encompasses Russia’s oil exports from its four main ports (Primorsk and Ust-Luga in the Baltic Sea, Novorossiysk in the Black Sea, and Murmansk in the Arctic Sea) to their principal destinations. Figure 6 illustrates these findings, unmistakably indicating a structural shift at the onset of the conflict, signifying a redirection in the destination of Russia’s oil exports from the EU and the US (considered as a group by the database provider, alongside Canada, the UK, and Japan) to China and India. The effectiveness of EU import restrictions is evident as imports plummeted from approximately seven million tons in February 2022 to less than two million tons by the year’s end. In the case of the US, trade bans were stringent, resulting in virtually zero imports. The surge in exports to countries less inclined to oppose Russian actions in Ukraine solidifies Chinaʼs second position and underscores India’s pivotal role as the two foremost markets for Russiaʼs oil.

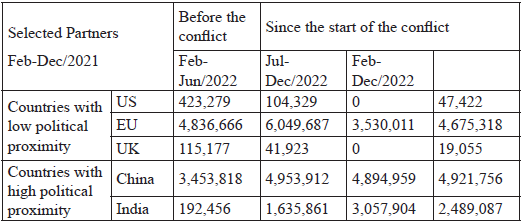

Furthermore, an additional avenue of exploration involves the computation of changes in bilateral exports in US dollars, drawing upon UN/Comtrade data. Table 1 elucidates the monthly imports of crude petroleum oils (HS Code 2709) from Russia’s primary buyers. Considering our aforementioned findings, destination countries are categorized into those exhibiting low political proximity (US, EU, and UK) and high political proximity (China and India). Monthly averages of oil imports delineate trade flows across two distinct periods: ‘before the conflict’ (2021) and “since the onset of the conflict” (2022). Within this latter period, we further dissect three specific monthly intervals: Feb-Jun/2022 and Jul-Dec/2022, delimited by the initiation of EU sanctions in June; and Feb-Dec/2022, encapsulating the entirety of the second period.Table 2.

Table 2. Monthly average of oil imports from Russia, selected partners, Feb/2021-Dec/2022, in US$ 1,000

Source: Authors’ elaboration based on raw data from UN/Comtrade (2023)

The primary outcome unequivocally underscores shifts in the destination patterns of Russian oil sales since the beginning of the conflict. Chinaʼs oil imports witnessed remarkable growth, escalating by approximately 46% in 2022 (Feb-Dec) compared to the preceding year. Notably, Indiaʼs acquisitions experienced an even swifter surge post-Feb/2022, with the value of oil imports skyrocketing nearly thirteen fold. The substantially augmented market share of India can be attributed to Russiaʼs pursuit of expansive markets with fewer restrictions on its political and military activities in Ukraine, coupled with the systematic discounts extended by Moscow to facilitate the export of substantial oil volumes. In 2022, for example, India paid $22 per barrel, a rate below the Brent oil price for Baltic Sea shipments (Babina et al., 2023). This type of discount has fostered a form of trade triangulation, where countries that banned Russian petroleum products have started acquiring these goods through India. As observed, India increased its imports of Russian crude oil and attracted greater value added to its own refining industry, thereby extracting profits from the Russian industry (Babina et al., 2023). Consequently, India seized an opportunity to gain market share, playing a key role in meeting European needs following the embargo on Russian imports (International Energy Agency, 2024).

Conversely, following this line of analysis, Western developed nations implemented stringent import barriers, leading to significant declines in oil imports. Both the US and the UK imposed import bans on Russian oil, driving import values to zero in the second semester of 2022. Despite the alignment of EU policies with the US and the UK, both in trade and in support of Ukraine, oil imports from Russia exhibited some rigidity in the first half of 2022, owing to Europe’s short-term energy dependence on Moscowʼs supply.

Functioning as a key player in the international oil market, Russia ostensibly sought alternative partners to redirect its exports following the escalation of the conflict and the ensuing trade restrictions. However, these newly identified destinations turned out to be countries with which Russia had established robust pre-existing connections, as evidenced by their political proximity. Therefore, the substantial upswing in bilateral trade, propelled by Russian initiative, unveils the political dimension of the network ties linking Russia with China and India, portraying the trade of strategic commodities as an extension of the geopolitical battleground.

4. Concluding remarks

In this study, we assess whether political similarities among key actors in international trade influence trade flows and partner preferences, particularly in the case of an indispensable and scarcely substitutable commodity like oil. We specifically examine the political and ideological convergence among major trade powers and its correlation with the significant shifts in the destinations of Russia’s oil exports following the onset of the conflict in Ukraine.

In terms of empirical investigation, our key findings are categorized as preliminary and main results. The preliminary findings highlight logistics aspects of Russiaʼs oil production, emphasizing the significance of geographic proximity and transport networks, particularly in Europe. Noteworthy is the observation that the US and the UK swiftly reacted and imposed stringent restrictions on oil deals with Russia, whereas continental European countries exhibited a comparatively slower and less stringent approach. The Russo-Ukrainian conflict has evidently resulted in adverse shocks to oil production, trade, and heightened economic and political uncertainty.

Regarding our main findings, the results ratify our hypothesis that the international trade of essential commodities, such as oil, is influenced not only by economic variables but also by a complex interplay of political and strategic interests. The evidence unequivocally supports a substantial growth in Russian oil exports to China and India, accompanied by a decline in traditional destinations like the US and the EU. China and India exhibit a great political alignment with Russiaʼs actions in Ukraine and emerge as key importers. Political proximity measures, including voting strategies at UN general assembly resolutions and participation in WTO trade disputes, reveal stable and high political alignment between Russia and China, and increasing alignment with India, while alignment with the US and European countries is found to be low.

Remarkably, the redirection of Russia’s oil exports aligns with political ties, substantiating the role of the oil market as a tool in international conflicts. Whether driven by trade restrictions in Western markets or economic and political opportunities in the East, the outcome underscores a shift from politically less friendly to more friendly countries. From an international relations standpoint, the results confirm the use of the oil market as a strategic tool in the context of complex interdependence, where both Europe and Russia employ trade measures to exert influence in the international conflict.

The examination of this empirical evidence suggests a potential theoretical revision of the concept of complex interdependence, as the traditional interpretation of the theory indicates a decrease in conventional military conflicts due to the strengthening of trade ties. However, in the case at hand, the opposite occurred: trade relations became militarized and instrumentalized, in order for countries to achieve their foreign policy objectives. From the Russian perspective, this is seen in the suppression of oil supplies to Europe while redirecting them to other partners. From the European perspective, it is clear that it consists in applying a range of sanctions aimed at undermining Russian economic activity.

A notable policy implication is the accentuation of the ongoing trend of Russia’s energy market pivot towards Asia. This realignment positions Russia closer, both economically and politically, to key players in the region, such as China and India, while distancing from Western market liberalism and democratic values. This shift aligns with the interest in developing Russiaʼs oil market in Asia and it represents an opportunity for countries to strengthen their relationship with Moscow, establishing new trade connections and becoming politically closer to Russia.

As our study predominantly focuses on the impact of political alignments on trade relations, future research avenues could delve into how political tensions, trade restrictions, and preferences contribute to hinder conflict resolution within a multilateral framework. Additionally, exploring the influence of emerging political and strategic actors, such as the BRICS and extended ASEAN, on this phenomenon could provide valuable insights.